Colorado Auto Loans | Vehicle Refinance

Saving More Money Never Felt So Easy

Apply online or contact us at 303.279.6414 to get started.

4.75% APR*

48 Month Term

4.75% APR*

60 Month Term

Financing 80% of Value or Less

5.34% APR*

96 Month Term

Must be under 1 year old with less than 10,000 miles

Have a quote elsewhere? We'll review to match or beat the rate so you can save even more.

Save time with refreshingly fast approvals.

GET APPROVED IN LESS THAN 5 MINUTESTerms Up To 96 Months Available

Up To 180 Months For Recreational Vehicles And Boats

HERE'S WHAT YOU CAN EXPECT WITH ON TAP

Expert Guidance

Save money and time transferring your vehicle with fast approvals and professional guidance.

Payment Vacation

Enjoy a 60-day payment vacation plus choose your own term and payment date to fit your schedule.

Vehicle Protection

Safeguard your investment with insurance and enhanced protection.

Jump-Start Your Refinance In 4 Easy Steps  |

|---|

STEP 1: LEARN WHAT YOU NEED TO SUCCEED

STEP 2: CALULATE A PAYMENT YOU CAN AFFORD

Take some time to review your budget and find the payment that fits you best. See how much you can save with a lower rate or how fast you could pay off your loan with a different term.

CALCULATE HOW MUCH YOU COULD SAVESTEP 3: APPLY IN MINUTES AND GET PRE-APPROVED

STEP 4: PROTECT AND INSURE YOUR NEW INVESTMENT

Guaranteed Asset Protection (GAP)

Protect your credit and savings by making sure your balance is covered if your vehicle is totaled.Extended Warranty

Credit Life and Disability Insurance

Never overpay for auto insurance again.

Frequently Asked Questions

Why refinance my auto loan with On Tap Credit Union?

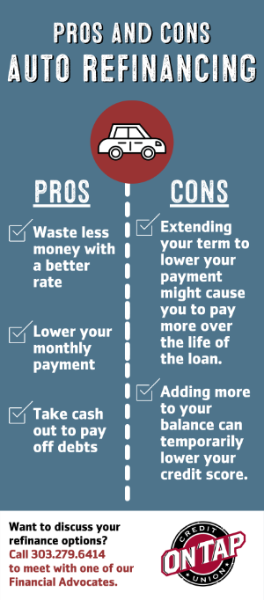

Refinancing with On Tap can help you lower your interest rate, reduce your monthly payment, or restructure your loan to better match your budget. It’s a smart move if interest rates have dropped since your original loan or your credit profile has improved as both could lead to long-term savings.

How much could I save by refinancing my car loan?

Potential savings depend on your current loan rate, remaining balance, and the terms of the new loan. A lower APR or extended loan term can lower monthly payments and reduce overall interest. Use a refinance savings calculator (or contact us for a quote) to compare and decide if refinancing is right for you.

When is a good time to refinance my car loan?

Consider refinancing if current market rates are lower than your existing loan rate, or if your credit or financial situation has improved. It’s also a good time to refinance if you want to lower monthly payments or shorten your loan term. That said, if your vehicle has high mileage or low value, or you owe nearly the full balance, refinancing may not offer much benefit.

What do I need to qualify for auto loan refinancing with On Tap?

You’ll typically need: valid government-issued ID, proof of income (like recent pay-stubs or tax returns), current vehicle registration and insurance, and a payoff statement from your existing lender.

Does refinancing always reduce my monthly payment?

Not necessarily. Refinancing can lower your payment if you secure a lower interest rate or extend your loan term. But if you shorten your loan term to pay off sooner, your monthly payment may stay the same or even increase so it depends on what you choose.

Will refinancing affect my credit score?

Applying for refinancing usually involves a hard credit inquiry, which may temporarily lower your score. Consistently making timely payments on the new loan can help improve your credit over time.

What kinds of protection or add-ons can I get when I refinance?

When you refinance with On Tap, you may choose optional protections such as GAP coverage, extended warranty/mechanical breakdown coverage, and loan payment protection (for disability or hardship). These add-ons can offer extra peace of mind, especially if you owe a significant balance or plan to keep your vehicle long-term.

How long does the refinancing process take with On Tap?

You can start the pre-approval online (takes just a few minutes) or in person. Once you submit required documents and your payoff statement, On Tap can finalize and fund the refinance often faster than the original loan setup.

Do I need to be a member of On Tap Credit Union to refinance?

Yes, membership is required for refinancing. If you're not already a member, we will complete your membership application together as part of your standard loan process. As a member, you will also have full access to all of the other services we provide.

Additional Resources For Your Refinance

earn More With The On Tap Credit Union Blog

DEEP DIVE:

Still have questions about completing your refinance?

Contact us to get started at 303.279.6414 or request a call or email back.

*APR = Annual Percentage Rate. Rates subject to change without prior notice. Rate received based on individual's credit history. Rates quoted are the lowest available rate to our customers with the automatic payment discount. Some rates based on credit score. Federally Insured by the NCUA

** With approved credit. Auto refi floor rate is as low as 4.75% APR. Terms vary by vehicle type and amount financed. Loan qualification and (APR) Annual Percentage Rate based on individual credit worthiness. A $10,000 loan for 48 months at 4.75% APR would result in a monthly payment of $187.58. Not all borrowers will qualify for the best rate and terms may vary on amount financed. Rates are subject to change. Finance charges begin at initial open date of loan.