Colorado Auto Loans And Rates | Vehicle Purchase

Enjoy More Time In Your New Vehicle And Less Time Financing It

Apply Online And Save Time On Your Purchase

HERE'S WHAT YOU CAN EXPECT WITH ON TAP

Expert Guidance

Speedy approvals and professional guidance from purchase to registration and beyond.

Flexible Payments

Choose your own term and payment date to fit your schedule.

Vehicle Protection

Safeguard your investment with insurance and enhanced protection.

Have a quote elsewhere? We'll review to match or beat the rate so you can save even more.

Jump-Start Your Purchase In 5 Easy Steps   |

|---|

STEP 1: LEARN WHAT YOU NEED TO SUCCEED

4.75% APR*

48 Month Term

4.75% APR*

60 Month Term

5.34% APR*

96 Month Term

Must be under 1 year old with less than 10,000 miles.

Terms Up To 96 Months Available

Up To 180 Months For Recreational Vehicles And Boats

YOU DON'T HAVE TO CLIMB A MOUNTAIN TO GET EVERY ADVENTURE STARTED

STEP 2: CALULATE YOUR PURCHASE

Take some time to review your budget and consider what you can spend. Be sure to include room in your budget to save for unexpected expenses and maintenance costs.

CALCULATE WHAT YOU CAN BUYAlready found the vehicle you want to purchase? Check the value here with NADA.

STEP 3: APPLY IN MINUTES AND GET PRE-APPROVED

STEP 4: SHOP SMART AND SAVE MORE WITH OUR PARTNERS

Looking to save even more money and time on your purchase? Our auto-buying partners offer more discounts and a wide inventory of vehicles from big to small. Check out what they have in stock and get the very best price you'll find in Colorado.

SEE INVENTORY AND MEET OUR PARTNERSSTEP 5: PROTECT AND INSURE YOUR NEW INVESTMENT

Guaranteed Asset Protection (GAP)

Protect your credit and savings by making sure your balance is covered if your vehicle is totaled.Extended Warranty

Credit Life and Disability Insurance

Never overpay for auto insurance again.

Frequently Asked Questions

How do auto loans work at On Tap Credit Union?

On Tap Credit Union offers flexible financing for new and used vehicles with transparent rates and no dealer markups. Apply online, get pre-approved, choose your vehicle, and enjoy clear monthly payments that fit your budget.

What credit score do I need to get approved for a car loan?

There is no strict minimum credit score required. We review your complete financial situation, including income and debt, and provide options tailored to many credit backgrounds.

How much can I get pre-approved for?

Your pre-approval amount depends on your credit, income, and debt-to-income ratio. Getting pre-approved upfront helps you shop confidently and avoid costly dealer financing surprises.

Are On Tap auto loan rates lower than dealership financing?

Often - Yes! Dealerships may add markups to loan rates. On Tap offers competitive, transparent rates with no hidden fees, and we can review outside offers to match or beat when possible.

Do I need a down payment?

A down payment isn’t always required, but it can reduce your monthly payment and total interest. Many members qualify with no down payment depending on their credit and vehicle choice.

What loan terms are available?

We offer a range of terms up to to 96 months. Shorter terms save on interest; longer terms lower monthly payments. Choose the plan that fits your financial goals.

Can I use an On Tap auto loan at any dealership or for private-party sales?

Absolutely. Our loans work for dealership purchases, private-party sales, and more. Private-party purchases may require additional documents, but we can help guide you through each step of the way.

What documents do I need to apply?

You’ll need ID, proof of income, insurance, and vehicle details. If you’re not sure what you’re buying yet, apply for pre-approval first - no vehicle details required!

How fast is approval?

Many applications receive a decision within minutes. Pre-approval helps speed up the buying process and gives you stronger negotiating power at the dealership.

Do I need to be a member?

Yes, membership is required to close the loan, and becoming a member is quick and easy. Membership is not required to apply for pre-approval. In most cases, you can become a member and complete your auto loan in the same session.

Additional Resources For Your Purchase

earn More With The On Tap Credit Union Blog

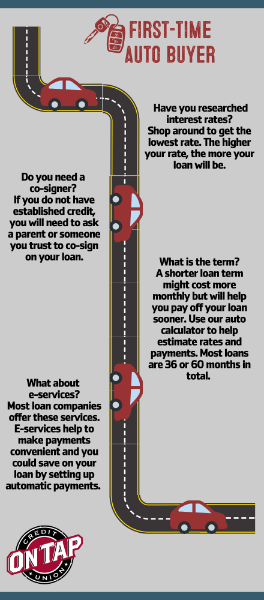

DEEP DIVE:

Preparing For Your First Purchase

Still have questions about financing your purchase?

** Terms vary by vehicle type and amount financed. Loan qualification and (APR) Annual Percentage Rate based on individual credit worthiness. Auto refinance floor rate is as low as 4.75% APR. For example, a $10,000 loan for 60 months at 4.75% APR would have monthly payments of approximately $187.58.Not all borrowers will qualify for the best rate and terms may vary on amount financed. Rates are subject to change. Finance charges begin at initial open date of loan.

.png)