On Tap Credit Union Home Page

.png)

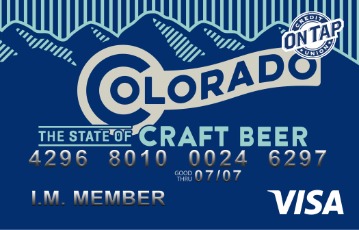

SWITCH TO A LOW INTEREST CREDIT CARD FROM ON TAP

Consolidate Debt With 6.99% APR* On Balance Transfers For The First Year

New Year -

New You!

Take our quick quiz and we'll get you set with the best resources and information to help keep your bank account growing while minimizing your debts. No matter where you are in life, we have resources to help you craft your next adventure so you can spend less time planning and more time enjoying.

Skip-A-Pay Loan Payment Solutions

FEATURED RATES

.png)

On Tap Online and Mobile Banking

Access your On Tap accounts any time, from anywhere, on any device.

Visit the App Store or Google Play to download the On Tap Mobile Banking app for your Android or iPhone.

.png)

“We were able to consolidate our debts into one credit card with a lower interest rate. We refinanced both our cars and we are now credit card debt free!! This means more vacation time for the family!”

Jennifer C. Member Since 2008

Member Owned. Colorado Proud.

Crafted Financial Solutions

Local Service - Nationwide Access

Judgement-Free Coaching

.png)

.png) Our 5-step process crafts solutions to simplify banking and help you make confident financial decisions with all of your banking needs conveniently "On Tap."

Our 5-step process crafts solutions to simplify banking and help you make confident financial decisions with all of your banking needs conveniently "On Tap."

What's On Tap

Get the latest news and information.

** Skip-A-Pay Loan Solutions - Excludes home loans (including mortgages and home equity lines of credit) and credit cards. In order to qualify, you must not have been late on any On Tap Credit Union loan payment, or have skipped two payments on the loan requested, in the past 12 months. You may not skip two consecutive loan payments. There is a $25 fee per skipped loan payment, which will be deducted from your On Tap Credit Union share or checking account. Interest will continue to accrue during the extension period at the same rate(s) as the original contract(s) and that the term and repayment period of the loan(s) will be extended due to this request. Additional documentation may be required. Additional restrictions may apply.

Federally Insured By The NCUA

.png)

.png)

.png)

.png)

.png)

.png)

.png)